What you need to know about the 2021 Child Tax Credit Changes

Under the American Rescue Plan Act of 2021, the new Child Tax Credit is a refundable credit worth up to $3,600 per qualifying child under 18. These changes are an increase from last year’s Child Tax Credit benefit of $2,000.

Related Topics

Qualifying families will receive half of their credit divided into 6 monthly payments deposited from July to December 2021. Families will receive the rest of the tax credit when they file their 2021 income taxes next year.

To be eligible for the credit, you must claim dependent children 17 and under who are a U.S. citizen, national, or resident alien and have a Social Security number. The child must be related to you and live with you at least six months of the year.

The benefit amount is determined by three factors per child: 1) the age of the child (under 6 or 6-17), 2) your filing status (single or married filing jointly), and 3) your modified adjusted gross income. The maximum benefit is $3,600 per child under age 6 and $3,000 for those older than 6 and under 18 years old; adults who file single are eligible for the maximum credit if their modified adjust gross income in 2021 is $75,000 or less, or $150,000 or less for married filing jointly adults. Once taxpayers reach these income thresholds, the benefit is gradually reduced to $2,000 per child.

The early distributions are automatically set to roll out starting in July 2021. The IRS will take the estimated credit you are due based on your 2020 taxes – for example, $3000 for a 16-year-old – and divide it in half, which is $1500. Then they will further divide it into 6 payments, which would be $250 ($1500/6). In this example, a family could expect to receive $250 per month from July to December and then the rest of the credit, $1500, in 2022, when they file their tax return next year.

If you didn’t file a return in 2020, then the IRS will look at 2019. For those who are not required to file taxes, the IRS has provided a portal for non-filers to submit information.

There are, however, some taxpayers who may choose to opt-out of the advance payments on the IRS website and file for the full payment on their next tax return. If you receive higher payments than you are eligible for on your 2021 taxes, you will have to pay back the IRS any amounts that you are overpaid.

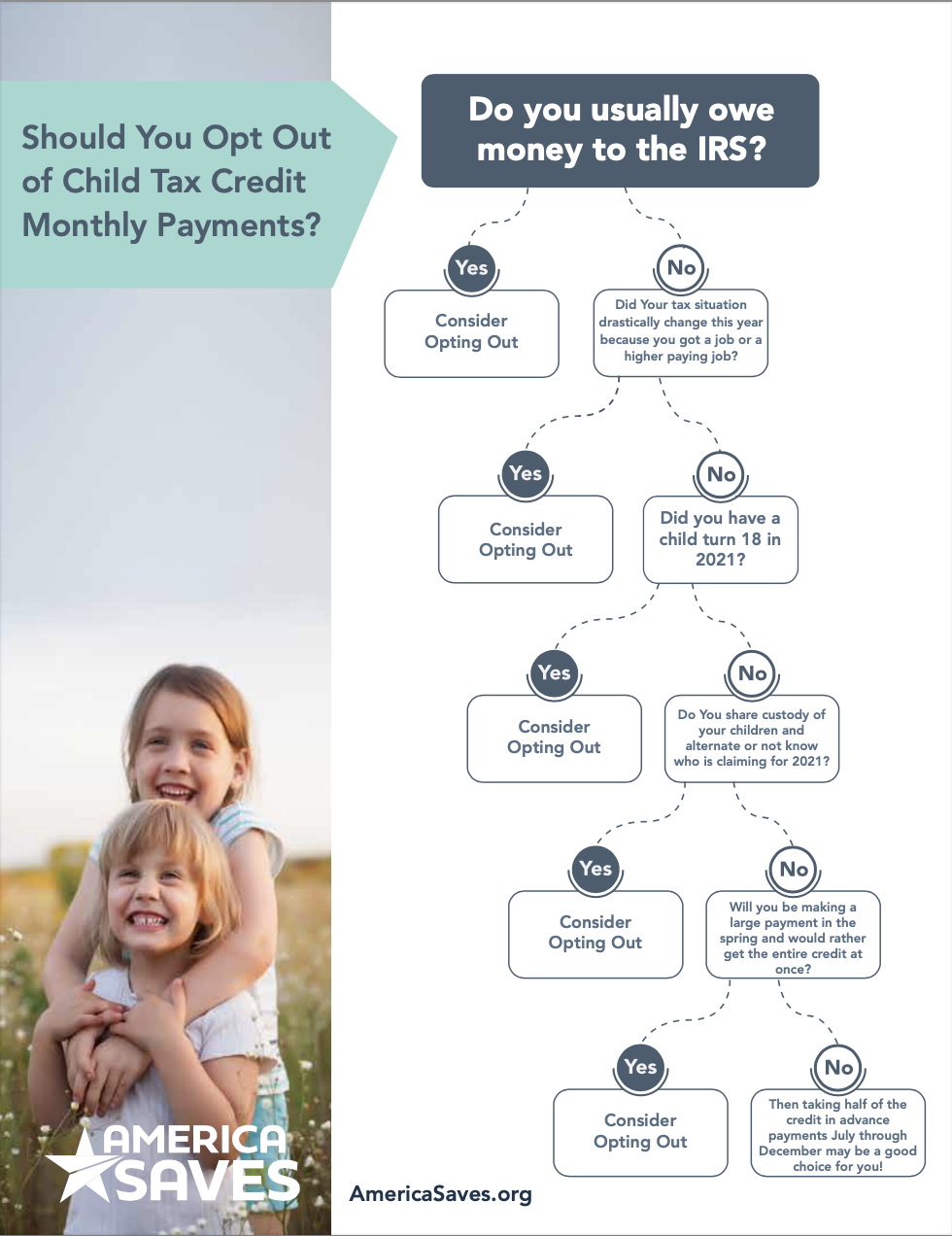

Reasons to opt out of the payments – do any of these situations apply to you?

- You usually owe money to the IRS

- Your tax situation has drastically changed this year because you got a job or a higher paying job

- You have children who are aging out of qualifying

- You share custody of your children and have not worked out who is claiming the credit

- You know you will be making a large payment in the spring and would rather get the entire credit at once

Reasons to take the advance payments: anything other than the above!

2021 Child Tax Credit Decision Tree

If you can check yes to all of these, then you might be eligible for the increased 2021 Child Tax Credit:

- Child is under 2) a U.S. citizen, national or resident alien 3) has a Social Security number 4) you claim them as a dependent on your tax return 5) child is related to you and 6) lives with you at least six months of the year.

And you can receive up to $3,600 per child. Single filers making $75,000 or less (or married filing jointly of $150,000 or less) who have a child under 6 will receive the maximum benefit of $3,600, whereas these groups will receive a $3,000 benefit for a child 6 – 17. Single filers making $75,000 to $200,000 will get a credit of at least $2,000; married filing jointly will get at least $2,000 if they make $150,000 to $400,000. The exact benefit amount decreases in $50 increments for every $1,000 over the income thresholds.

If you don’t opt out, you will get half of your credit in 6 monthly payments July through December, and the other half when you file your 2021 taxes.

The 2021 Child Tax Credit Benefit Amount Chart

The 2021 Child Tax Credit increases the potential credit up to $3600 per child and is being distributed in two parts: half July through December and the other half when you file your 2021 taxes.

If you can check yes to all of these, then you might be eligible for the benefit:

- Child is under 2) a U.S. citizen, national or resident alien 3) has a Social Security number 4) you claim them as a dependent on your tax return 5) child is related to you and 6) lives with you at least six months of the year.

If you are Single Making:

Less than $75,000

- Each child up to 5 years old on 12/31/2021 = Benefit of $3,600

- Each child 6 - 17 years old on 12/31/2021 = Benefit of $3,000

$75,000 - $200,000

- Each child up to 5 years old on 12/31/2021 = Benefit of $3,575 - $2,000

- Gradually reduced in $50 increments by AGI over $75,000

- Each child 6 - 17 years old on 12/31/2021 = Benefit of at least $2,000

- Gradually reduced in $50 increments by AGI over $75,000

Over $200,000

- Each child up to 5 years old on 12/31/2021 = For each $1,000 over $200,000, reduce $2,000 credit by $50

- Each child 6 - 17 years old on 12/31/2021 = For each $1,000 over $200,000, reduce $2,000 credit by $50

If you are Married Filing Jointly, Making:

Less than $150,000

- Each child up to 5 years old on 12/31/2021 = Benefit of $3,600

- Each child 6 - 17 years old on 12/31/2021 = Benefit of $3,000

$150,000 - $400,000

- Each child up to 5 years old on 12/31/2021 = Benefit of $3,575 - $2,000

- Gradually reduced in $50 increments by AGI over $75,000

- Each child 6 - 17 years old on 12/31/2021 = Benefit of at least $2,000

- Gradually reduced in $50 increments by AGI over $75,000

Over $400,000

- Each child up to 5 years old on 12/31/2021 = For each $1,000 over $200,000, reduce $2,000 credit by $50

- Each child 6 - 17 years old on 12/31/2021 = For each $1,000 over $200,000, reduce $2,000 credit by $50

Related Tags

CHECK OUT OTHER SAVINGS JOURNEYS FROM SAVERS JUST LIKE YOU

Taking Steps Toward Financial Fitness

By Nicky Vasquez

Nicky Vasquez learned about Virginia Saves when she attended her first class with Bank On Virginia Beach. The instructor shared how important it was to have a written savings goal, and the entire class joined Virginia Saves as the first step toward financial fitness.

Saver Story: Set a goal, make a plan!

By Shannon

We've chosen Shannon as our Saver of the Month! Her approach to saving for her family’s dream home is a g...

Saving With My Boys

By Kelly

Kelly has made saving a family effort. She started her boys saving early. “Probably 3,” Kelly told us, “w...

Saving Early: Key to Successful Future

By Johnnie Lovett

For Johnnie Lovett, a Young Illinois Saver, saving has been a habit since he was a teenager. “As a teenag...

Budget like Nohemi

By Nohemi

Nohemi found out about America Saves a few years ago as an undergraduate at the University of Illinois at...

Developing a Savings "Game Plan"

By Eunice Diaz

Eunice Diaz, a teacher in Colorado Springs, had been noticing a pattern. Despite the fact that she and her husband were “making good money,” they were spending their entire earnings and “were still struggling at the end of the month.”

Saving Early: Key to Successful Future

By Johnnie Lovett

For Johnnie Lovett, a Young Illinois Saver, saving has been a habit since he was a teenager. “As a teenag...

Saving for a Bright Future

By Kristin Hendricks

Kristin Hendricks, a single mother from Texas, understands the importance of saving money and following a...

Savings #ImSavingForSweepstakes

#ImSavingFor Winner Story

By Pedram R.

America Saves awarded one lucky saver, Pedram R. from California, $750 for sharing his #ImSavingFor story...

A Think Like A Saver Attitude

By Melissa

Melissa has always been thrifty with a #ThinkLikeASaver attitude. This served her family well when her hu...

A Think Like A Saver Attitude

By Melissa

Melissa has always been thrifty with a #ThinkLikeASaver attitude. This served her family well when her husband lost his job in 2014. Using their savings, Melissa’s family stayed afloat while her husband found a new job.

A Think Like A Saver Attitude

By Melissa

Melissa has always been thrifty with a #ThinkLikeASaver attitude. This served her family well when her husband lost his job in 2014. Using their savings, Melissa’s family stayed afloat while her husband found a new job.

Saving With My Boys

By Kelly

Kelly has made saving a family effort. She started her boys saving early. “Probably 3,” Kelly told us, “w...

Don’t Laugh at Saving Spare Change

By Brittany

Virginia Saves saver, Brittany, decided to start saving again when she became a single mother. She thinks...

Put 20 Percent Away

By Melissa

“I am a single mother, and I make ends meet for me and my daughter, but I wanted to put money away for my...

Jump-Starting a Financial Makeover

By Nichelle Johnson

Nichelle Johnson, a single mom with two teenage children, knows what it’s like to stretch a dollar. When ...

Put 20 Percent Away

By Melissa

“I am a single mother, and I make ends meet for me and my daughter, but I wanted to put money away for my daughter for a college fund. So I started saving 20 percent of my paycheck every month to put it away in a savings account with a high Annual Percentage Yield (APY). By the time my daughter is 18, I will have saved nearly $90,000.”

Saving With My Boys

By Kelly

Kelly has made saving a family effort. She started her boys saving early. “Probably 3,” Kelly told us, “w...

Budget like Nohemi

By Nohemi

Nohemi found out about America Saves a few years ago as an undergraduate at the University of Illinois at...

Saving is a Family Affair

By Jeff

Saving is truly a family affair for Jeff’s household. During America Saves Week 2019, he pledged to save ...

Starting and Continuing a Personal Finance Journey

By Kiara Hardin

When Kiara Hardin, now a junior at Western Illinois University, became an intern with the Chicago Summer ...

Getting Out of Debt

By Tonya Shelton

In 2004, Tonya Shelton was facing financial ruin. Barely making more than minimum wage and having lost her home to an unexpected family crisis, Shelton and her family were forced to live in a rundown hotel.

Taking Back Control Over Finances

By Nadine Bialo

After becoming a Virginia Saver and getting help from BankOn classes and coaching, Nadine Bialo took back...

Inspired to Build Savings By Starting Small

By Sharon

With little-to-no money in the bank and living on a limited income with her adult daughter, Sharon wasn’t...

From Overwhelmed to In Control

By Debi

In 2017 Debi felt overwhelmed. Her credit cards were maxed, and she wasn't exactly sure how to handle it....

Developing a Savings "Game Plan"

By Eunice Diaz

Eunice Diaz, a teacher in Colorado Springs, had been noticing a pattern. Despite the fact that she and he...

Savings #ImSavingForSweepstakes

#ImSavingFor Winner Story

By Pedram R.

America Saves awarded one lucky saver, Pedram R. from California, $750 for sharing his #ImSavingFor story. Pedram said, “Saving is important to me because it proves I am not willing to buy unnecessary things to please others or to be perceived as successful.”

Saving is a Family Affair

By Jeff

Saving is truly a family affair for Jeff’s household. During America Saves Week 2019, he pledged to save for retirement. But making a commitment and creating a plan to save isn’t a new concept for him.

Getting Out of Debt

By Tonya Shelton

In 2004, Tonya Shelton was facing financial ruin. Barely making more than minimum wage and having lost her home to an unexpected family crisis, Shelton and her family were forced to live in a rundown hotel.

If we feature you in our newsletter, you get $50.

You May Also Be Interested In...

Take the America saves pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and America Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!

creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the America Saves Pledge is a pledge to yourself to start a savings journey and America Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

Congrats on completing the pledge!

We are so glad you have started your savings journey and Military Saves will be right beside you the whole way! You will soon receive an email from the Military Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

Take the America Saves Pledge

Make a pledge to yourself and create a simple savings plan that works.